Toocle Global - a B2B platform for sourcing from China

Sign In

-

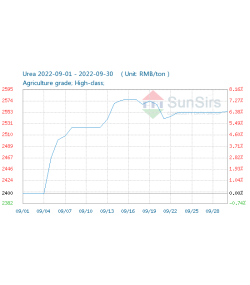

2022-10-10 16:46:19It can be seen from the figure above that the price of domestic mainstream urea market rose slightly this month: the urea price rose from 2,400.00 RMB/ton at the beginning of the month to 2,555.00 RMB/ton at the end of the month, an increase of 6.46%. A year-on-year decrease of 9.29%.

On September 29, the urea commodity index was 118.74, unchanged from the previous day, 22.05% lower than the cycle's highest point of 152.33 points (2022-05-15), and 113.56% higher than the lowest point of 55.60 points on August 17, 2016. (Note: Period refers to 2011-09-01 to now)

Analysis review

In September, urea prices rose in shock, with a weekly maximum increase of 2.31%. From the manufacturer's quotation, the price of domestic urea mainstream market rose slightly this month: the urea price Ruixing Chemical at the end of the month was 2,540 RMB/ton, which was 180 RMB/ton higher than that at the beginning of the month; The urea price of Hualu Hengsheng at the end of the month was 2,515 RMB/ton, which was 155 RMB/ton higher than that at the beginning of the month; The urea price of Xiangcheng San'an at the end of the month was 2,700 RMB/ton, which was 100 RMB/ton higher than that at the beginning of the month.

The upstream support increased, and the downstream demand was good

From the upstream and downstream industrial chain data, the urea upstream products in this month as a whole saw a sharp rise: the price of LNG rose sharply, from 5,892.00 RMB/ton at the beginning of the month to 6,950.00 RMB/ton at the end of the month, an increase of 17.96%, and up 23.01% year-on-year. The price of anthracite rose slightly, from 1,570.00 RMB/ton at the beginning of the month to 1,850.00 RMB/ton at the end of the month, an increase of 280 RMB/ton. The price of melamine at the downstream of urea fell in shock this month, from 8,300.00 RMB/ton at the beginning of the month to 8,266.67 RMB/ton at the end of the month, down 0.40%.

From the perspective of demand: agricultural demand had a small stock of goods, while industrial demand gradually increased. The operating rate of the rubber sheet plant was low, mainly purchased on rigid demand. The operating rate of the compound fertilizer plant increased, and the demand for urea increased slightly. The price of melamine fell slightly, and the enthusiasm for urea procurement was general. In terms of supply, it is expected that some regions will have limited production, and the daily output of urea will be about 150000 tons.

Market outlook

The urea market may rise slightly in mid October and early October. The upstream anthracite and natural gas prices rose slightly, and cost support increased. The downstream agricultural demand followed up appropriately, and the industrial demand was purchased on demand. In the future, urea may rise slightly in shock.#urea#

Leads

Trends for you