Toocle Global - a B2B platform for sourcing from China

Sign In

-

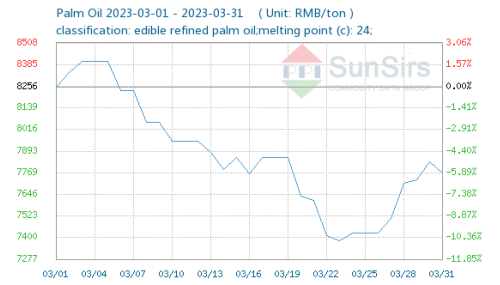

2023-04-03 13:30:38According to the monitoring data of SunSirs, since March, the palm oil market has declined first and then increased, with insufficient rebound and overall decline. On March 1, the average market price of palm oil was 8,256 RMB/ton, while on March 31, the average market price of palm oil was 7,768 RMB/ton, a decrease of 5.91%.

Analysis review

Poor terminal demand, palm oil market continued to decline

Since March, the spot market of palm oil has been rising weakly, with a weak trend dominated by a downward trend. This was mainly due to the poor performance of Malaysia's palm oil market and the decline of US soybean oil market, which was dominated by negative fundamentals. The demand in the terminal catering industry weakened, and the oil market had been suppressed. The import of edible vegetable oil had increased, and palm oil inventories were operating at a high level. Multiple negative factors were superimposed, and the palm oil spot market continued to oscillate and decline, with a maximum decline of over 5%.

In the middle of the month, the performance of the external oil market remained poor, with terminal oil consumption demand sluggish. Catering enterprises purchased and used as needed, and the market turnover was general. Palm oil inventories continued to be high, expanding the decline.

At the end of the month, the palm oil market was at a low level and began to rebound. The price rose by more than 5% from the 22nd.

Market outlook

Agricultural product analysts from SunSirs believe that in April, the terminal demand for oil and fats will remain weak, while external negative factors remains and there is still room for palm oil prices to fall in the future.#Palm Oil#

Leads

Trends for you